Understanding Curve (v1)

Getting started with Curve isn’t easy, there is a lot to grasp and the unique UI can be a lot to take in. This small guide is intended for Curve beginners with an understanding of DeFi and Crypto. It tries to answer recurring questions about how to get started with Curve and how it works or makes money for liquidity providers.

What is Curve.fi?¶

The easiest way to understand Curve is to see it as an exchange. Its main goal is to let users and other decentralised protocols exchange ERC-20 tokens (DAI to USDC for example) through it with low fees and low slippage. Unlike exchanges that match a buyer and a seller, Curve uses liquidity pools. To achieve successful exchange volume, Curve needs a high volume of liquidity (tokens) and therefore offers rewards to liquidity providers.

Curve is non-custodial, meaning the Curve developers do not have access to your tokens. Curve pools are also non-upgradable, so you can have confidence that the logic protecting your funds can never change.

What are liquidity pools?¶

Liquidity pools are pools of tokens that sit in smart contracts and can be exchanged or withdrawn at rates set by the parameters of the smart contract. Adding liquidity to a liquidity pool gives you the opportunity to earn trading fees and possibly rewards. For more information, visit the following section:

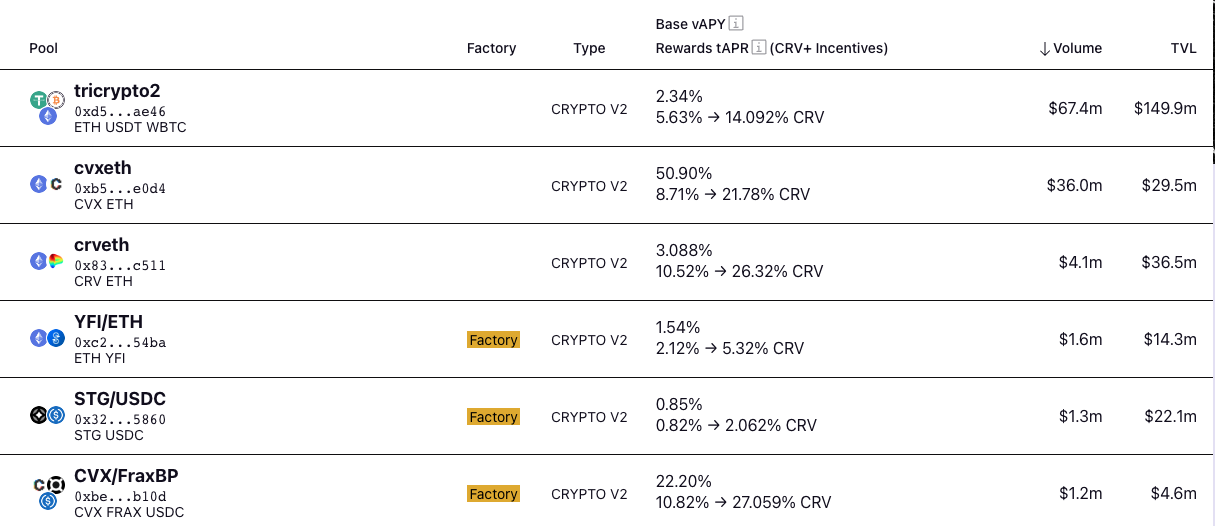

What are those percentages next to each pool?¶

Curve pools may have several different percentages shown next to them in the UI.

The first column, vAPY, refers to the annualized rate of trading fees earned by liquidity providers in the pool. Any activity on every Curve pool generates fees, a portion of which accrue to everybody who has a stake in the pool. Further information is in the Liquidity Provider section.

The second column refers to the reward gauges. This entitles liquidity providers to earn bonus CRV emissions. More detail on these bonuses are in the Reward Gauges section.

What is the CRV token?¶

CRV token is a governance and utility token for Curve.

Can I use Curve on sidechains?¶

Yes. Curve has launched on several sidechains and will continue to do so. Visit our section on Multichain for more information.

How Can I Launch a Pool¶

All new Curve pools are deployed permissionlessly through the Curve Factory. This means anybody can deploy a pool anytime, anywhere. For a full guide, check our Factory Pools section.

Why has Curve grown so quickly?¶

When Curve launched it grew quickly by securing the underdeveloped stablecoin market. Stablecoins have become an inherent part of cryptocurrency for a long time but they now come in many different flavours (DAI, TUSD, sUSD, bUSD, USDC and so on) which means there is a much bigger need for crypto users to move from a stable coin to another. Centralised exchanges tend to have high fees which are problematic for those trying to move from a stable coin to another. As a result, Curve.fi has become the best place to exchange stable coins because of its low fees and low slippage.

More recently, Curve launched v2 Crypto Pools to bring the same simplicity and efficiency of Curve's stablecoin pools to transactions between differentially priced assets (ie BTC and ETH). These pools are sufficiently different to justify their own section:

Where can I find Curve smart contracts?¶

The Github repository also open sources the bulk of Curve development activity.

Whitepaper¶

StableSwap (Curve V1) Whitepaper

For a detailed overview of Curve V1, please read the official whitepaper.