Opening a Loan with a Custom Number of Bands

To follow this guide, make sure "Advanced Mode" is enabled in your user settings.

Before diving in, please make sure you're familiar with the concept of bands. You can read more about them here.

This guide is very similar to the Beginner: Open & Close tutorial. The only difference is that you’ll be able to set a custom number of bands — which defaults to 10 in non-advanced mode. Everything else works exactly the same.

Make sure you understand the consequences and benefits of using more or fewer bands. You’ll find a quick summary further down in this guide, or read more here.

Customizing Bands¶

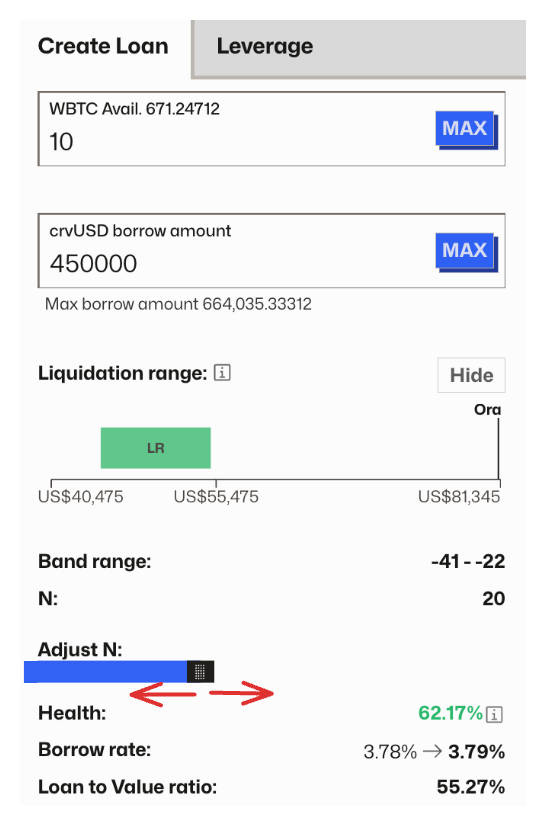

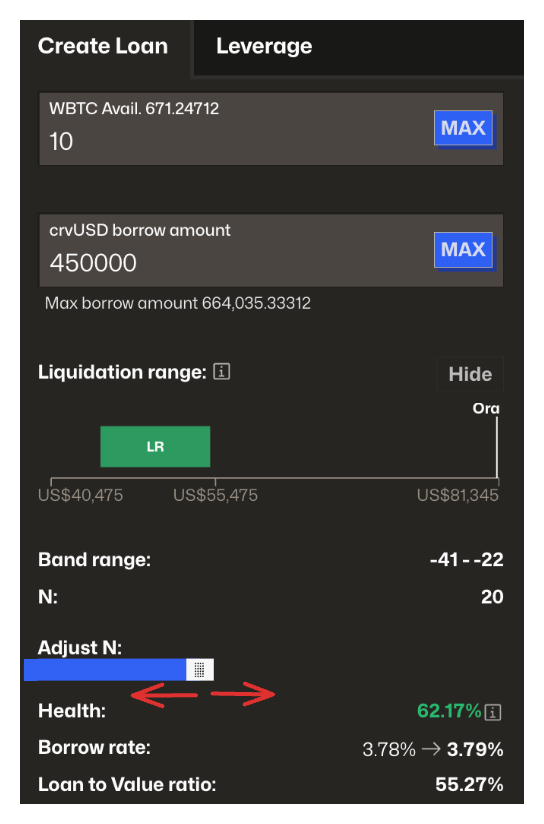

Simply enter the amount of collateral you want to use and choose how much crvUSD to borrow. Additionally, you can adjust the number of bands for the loan by moving the slider left or right.

- Minimum bands: 4

- Maximum bands: 50

Effects of Number of Bands¶

The maximum LTV (Loan-To-Value ratio — the maximum amount you can borrow against your collateral) is heavily influenced by the number of bands selected when opening a loan.

In general:

- The fewer bands you use, the higher your borrowing power (LTV)

- The more bands you use, the lower your potential losses during soft-liquidation

This creates a trade-off between maximum borrowing capacity and protection from liquidation losses.

If you're actively monitoring your loan and plan to repay or close it before entering soft-liquidation, using fewer bands may allow you to borrow more efficiently.

If you prefer a more conservative approach, using more bands will help reduce potential losses if liquidation occurs.

Ultimately, it's a trade-off between risk and borrowing power, and you should choose the configuration that best fits your goals and risk tolerance.

Maximum LTV is calculated using the following formula:

Where:

- \(\text{loan_discount}\) is a protocol-defined parameter, typically set to 7%

- \(A\) is the maximum allowed number of bands, which varies by market and is visible in the UI

- \(N\) is the number of bands selected for the loan