Loan Details & Concepts

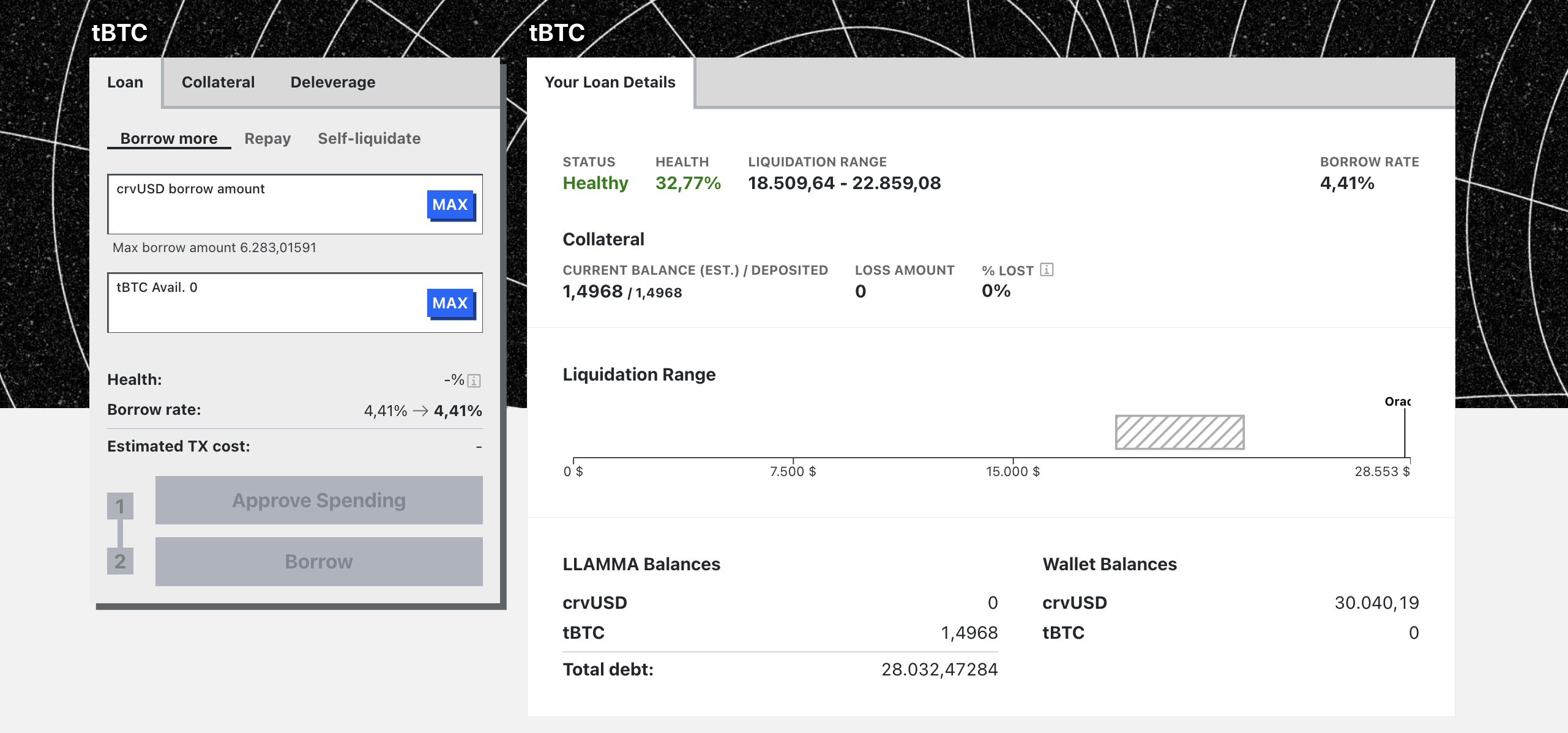

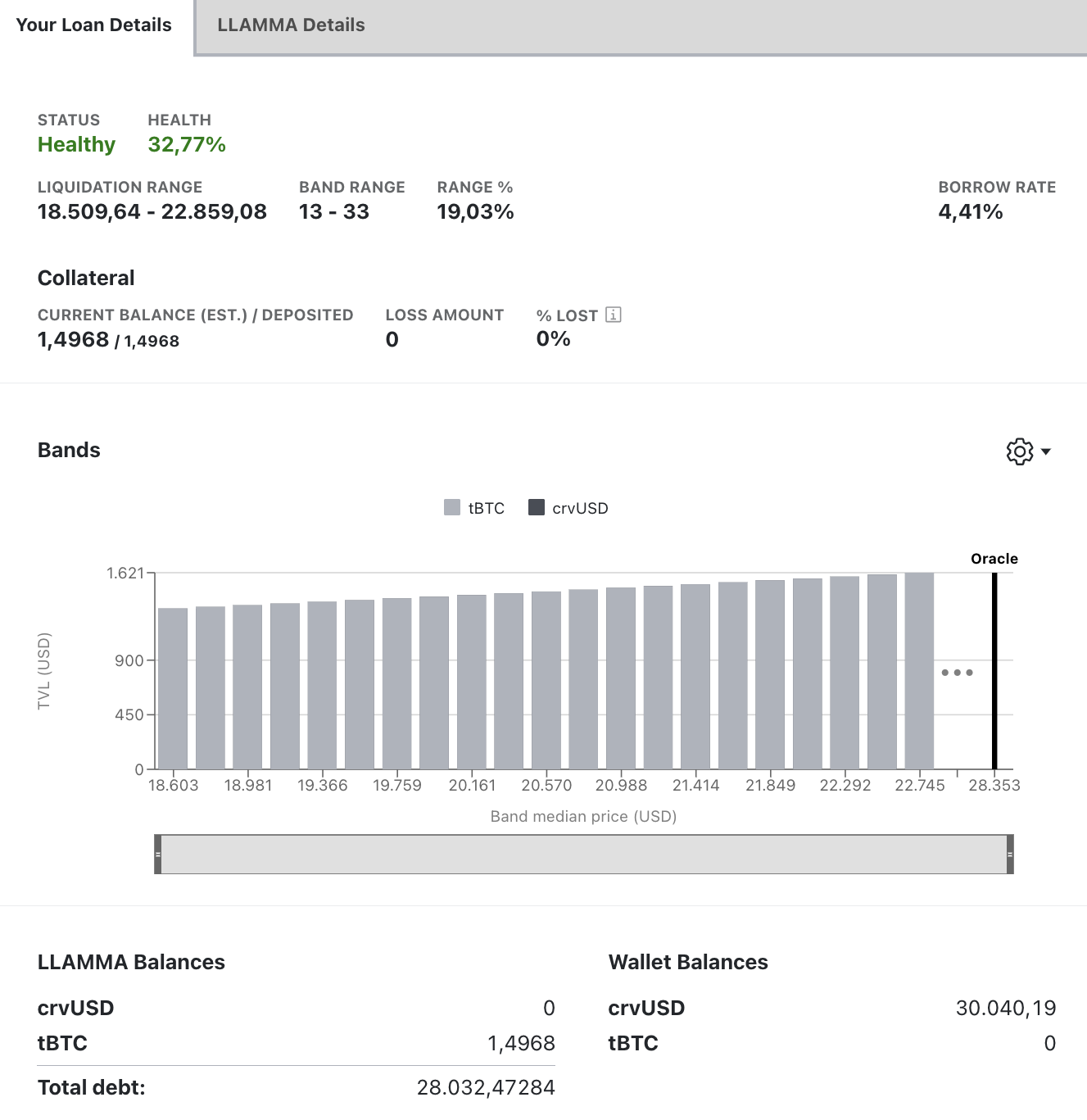

The Loan Details page displays information of an individual loan, along with features necessary for loan management.

Loan Details¶

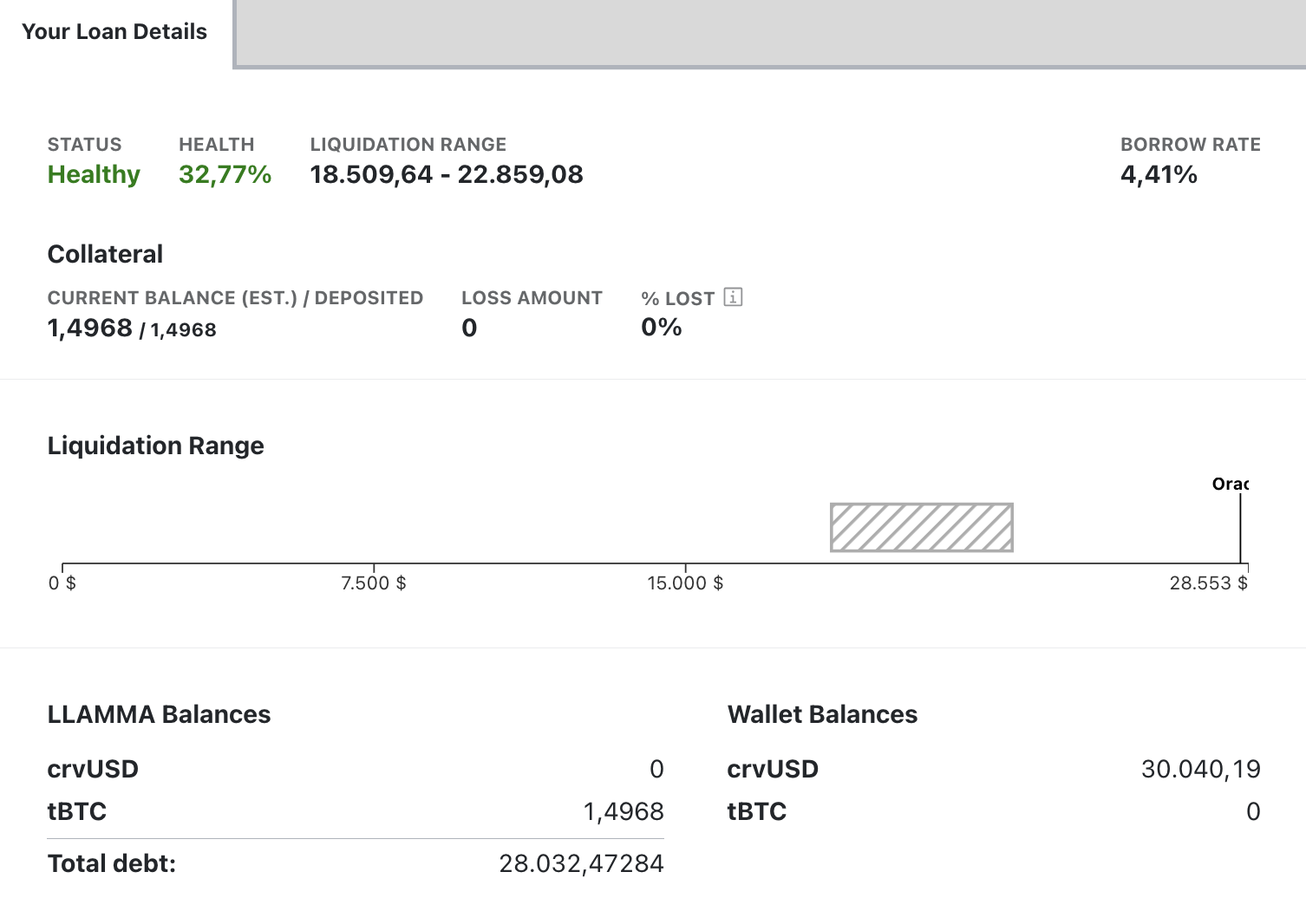

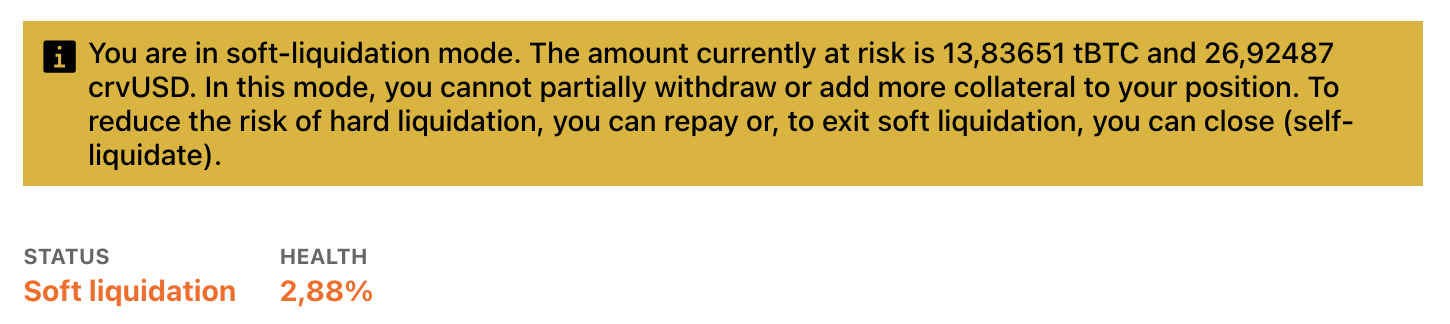

When a user creates a loan, their collateral is allocated across a range of liquidation prices. Should the asset price fall within this range, the loan will enter soft-liquidation mode. In this state, the user is not allowed to add additional collateral. The only recourse is to either repay with crvUSD or to self-liquidate the loan.

The section on the bottom of the page provides information about the entire LLAMMA system, showing aspects such as the total amount of debt, along with individual wallet balances.

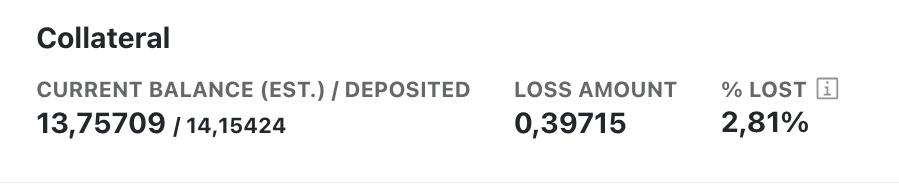

When a position was or is in soft-liquidation mode, losses occur. The UI displays the total LOSS AMOUNT as well as the % LOST, which measures the loss in collateral value caused by the soft-liquidation process.

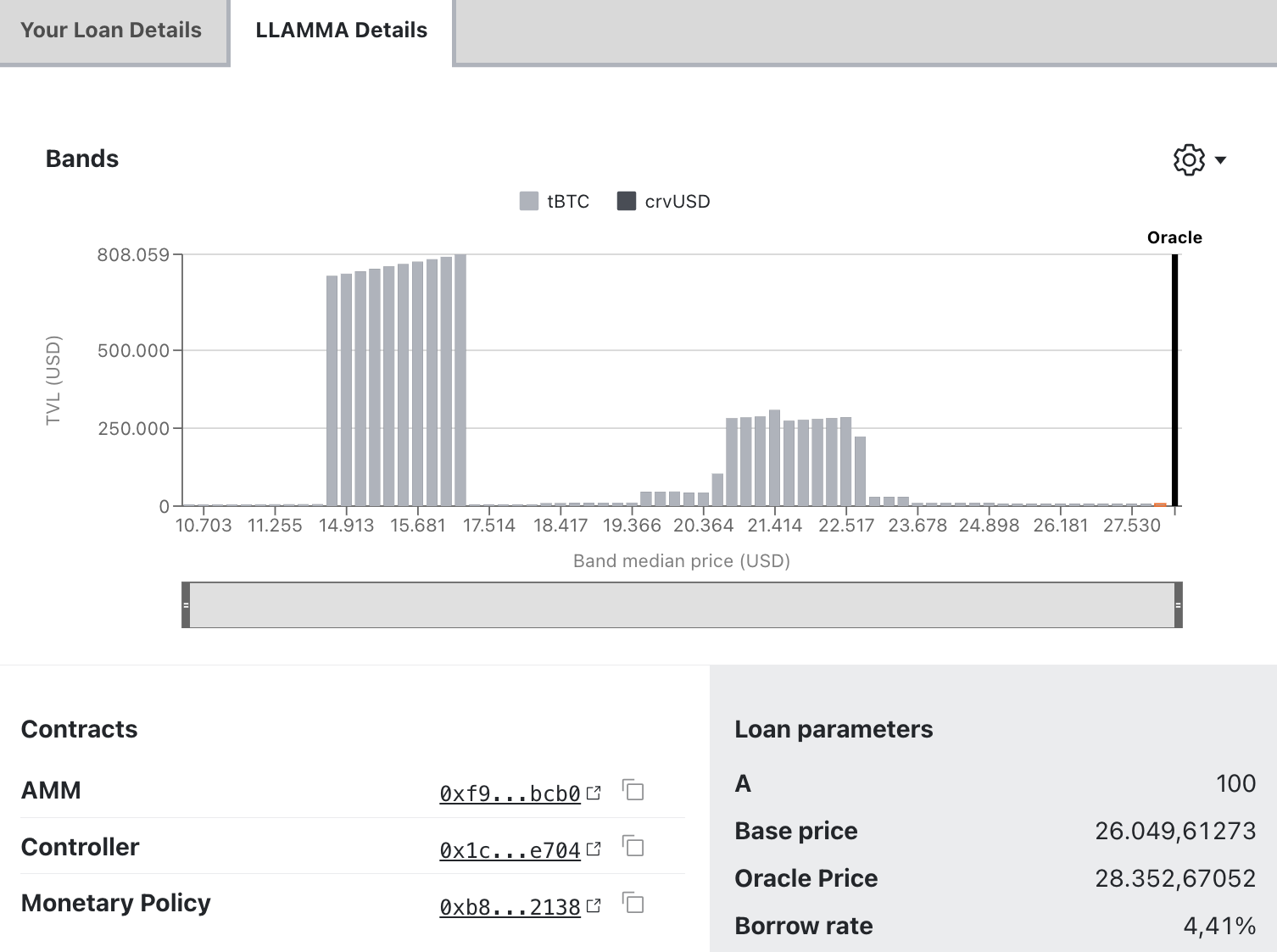

On the upper right-hand side of the screen, switching to advanced mode provides additional details about the loan.

In advanced mode the UI shows more information about the collateral bands.

Advanced mode also adds a tab with more info about the entire LLAMMA.

Loan Parameters¶

- A: The amplification parameter A defines the density of liquidity and band size.

- Base Price: The base price is the price of the band number 0.

- Oracle Price: The oracle price is the current price of the collateral as determined by the oracle. The oracle price is used to calculate the collateral's value and the loan's health.

- Borrow Rate: The borrow rate is the annual interest rate charged on the loan. This rate is variable and can change based on market conditions. The borrow rate is expressed as a percentage. For example, a borrow rate of 7.62% means that the user will be charged 7.62% interest on the loan's outstanding balance.

crvUSD Concepts¶

LLAMMA and Liquidations¶

LLAMMA (Lending-Liquidating AMM Algorithm) is a fully functional two-token AMM containing the collateral token and crvUSD, which is responsible for the liquidation mechanism. For more detailed documentation, please refer to the technical docs.

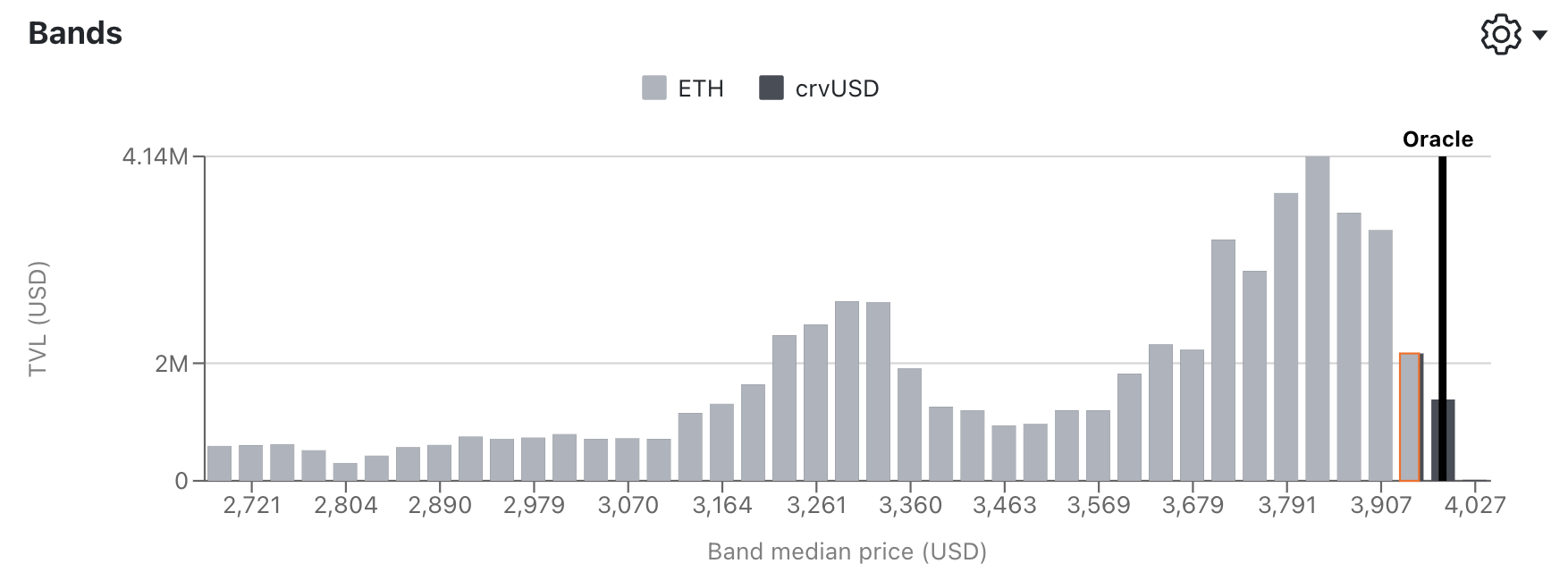

When creating a new loan, the put-up collateral will be deposited into a specified number of bands across the AMM. Unlike regular liquidation, which has a single liquidation price, LLAMMA has multiple liquidation ranges (represented by the bands) and continuously liquidates the collateral if needed.

All bands have lower and upper price limits, each representing a "small liquidation range." The user's total liquidation range is represented by the upper price of the highest band to the lower price of the lowest band.

A loan only enters soft-liquidation mode once the price of the collateral asset is within a band. If the price is outside the bands, there is no need to partially liquidate and therefore not in soft-liquidation.

The AMM works in a way that the collateral price within the AMM and the "regular price" are treated a bit differently. If the price falls into a band, prices are adjusted in a way that external arbitrageurs are incentivized to sell the collateral token and buy crvUSD in the band. So, if the price is within a band, the user's collateral will be sold for crvUSD, meaning the user's collateral is now a combination of both tokens. This happens for each individual band the user has liquidity deposited into.

This liquidation process does not only happen when prices fall but also when they rise again. If the collateral in a band has been fully converted into crvUSD and the collateral price rises again, the earlier sold-off collateral will be bought up again.

In short: External traders will soft-liquidate a users collateral when the collateral token's price is falling and de-liquidate it again when prices rise again.

Losses in Soft-Liquidation

Positions in soft-liquidation / de-liquidation are suffering losses due to the selling and buying of collateral. If the position is not in soft-liquidation, no losses occur. These losses decrease the health of the loan. Once a user's health is at 0%, the user's position may face a hard-liquidation, which closes the loan.

Bands (N)¶

When creating a loan, the added collateral is spread among the number of bands selected. Minimum amount is 4 bands, and the maximum amount is 50 bands.

A band essentially is a price range, with an upper and lower price limit. If the price of the collateral is within the limits of a band, that particular band is likely to be liquidated.

In the illustration above, there are multiple bands with different price ranges. The light grey areas represent the collateral token, which in this example is ETH. As depicted, the bands below the collateral token's price are entirely in ETH since there is no need for liquidation, given the higher price. The dark grey areas represent crvUSD. Because the price of ETH fell within the band on the far right, the deposited collateral (ETH) is converted into crvUSD. In this instance, the band consists of both ETH and crvUSD. If the price continues to decline, all collateral in the band will be fully converted into crvUSD, and the band to the left will undergo soft-liquidation.

Remember: When prices rise again, the opposite is happening. The ETH which was converted into crvUSD earlier will be converted back into ETH again.

Loan Health¶

Based on a user's collateral and debt amount, the UI will display a health score and status. If the position is in self-liquidation mode, an additional warning will be displayed. Once a loan reaches 0% health, the loan is eligible to be hard-liquidated. In a hard-liquidation, someone else can pay off a user's debt and, in exchange, receive their collateral. The loan will then be closed.

The health of a loan decreases when the loan is in self-liquidation mode. These losses do not only occur when prices go down but also when the collateral price rises again, resulting in the de-liquidation of the user's loan. This implies that the health of a loan can decrease even though the collateral value of the position increases. If a loan is not in self-liquidation mode, then no losses occur.

Losses are hard to quantify. There is no general rule on how big the losses are as they are dependent on various external factors such as how fast the collateral price falls or rises or how efficient the arbitrage is. But what can be said is that the losses heavily depend on the number of bands used; the more bands used, the fewer the losses.

Borrow Rate¶

The borrow rate is variable and dependent on various parameters and factors such as the price of crvUSD, PegKeeper debt, etc.

The formula for the borrow rate is as follows:

with:

r: The interest rate.rate0: The rate when PegKeepers have no debt and the price of crvUSD is excatly 1.00.price_peg: Desired crvUSD price: 1.00price_crvusd: Current crvUSD price.DebtFraction: Ratio of the PegKeeper's debt to the total outstanding debt.TargetFraction: Target fraction.PegKeeperDebt: The sum of debt of all PegKeepers.TotalDebt: Total crvUSD debt across all markets.

A tool to experiment with the interest rate model is available here.

PegKeeper¶

A PegKeeper is a contract that helps stabilize the crvUSD price. PegKeepers are deployed for special Curve pools, a list of which can be found here.

PegKeepers take certain actions based on the price of crvUSD within the pools. All these actions are fully permissionless and callable by any user.

When the price of crvUSD in a pool is above 1.00, they are allowed to take on debt by minting un-collateralized crvUSD and depositing it into specific Curve pools. This increases the balance of crvUSD in the pool, which consequently decreases its price.

If a PegKeeper has taken on debt by depositing crvUSD into a pool, it is able to withdraw those deposited crvUSD from the pool again. This can be done when the price is below 1.00. By withdrawing crvUSD, its token balance will decrease and the price within the pool increases.