Understanding crvUSD

Curve Stablecoin infrastructure enables users to mint crvUSD using a variety of crypto collaterals.

Positions are managed passively: if the price of the collateral decreases, the loan automatically enters a soft-liquidation mode, wherein some of the collateral is converted to crvUSD. Conversely, if the collateral's price increases, the system reclaims the collateral by converting crvUSD back to the collateral token.

However, this process may incur some losses due to the soft-liquidations and de-liquidations.

Manage crvUSD positions at https://crvusd.curve.fi/.

Markets¶

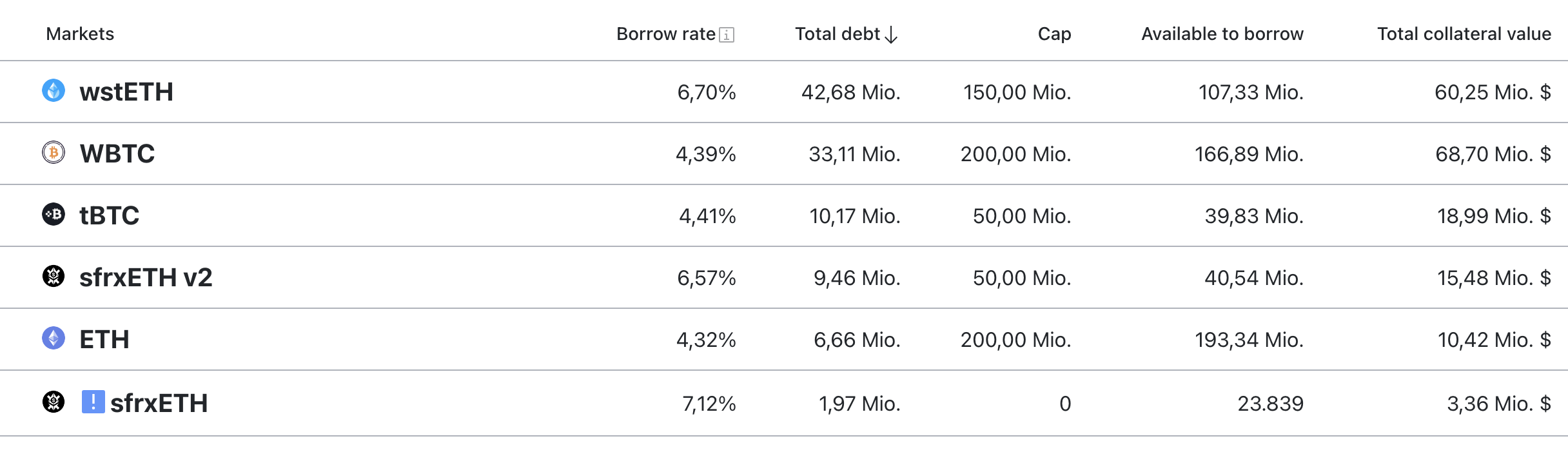

On the Markets tab, all available collateral types are displayed.

The page displays the current borrow rate, total debt, debt cap, remaining amount available for borrowing, and the total value of collateral.

If a user does not have an existing loan, clicking on any market will lead to the loan creation interface.

Should a loan already exist, a dollar sign overlay will appear on the left. Selecting the market in this case will lead to the loan management interface.

Risks¶

Please consider the following risk disclaimers when using the Curve Stablecoin infrastructure:

- If your collateral enters soft-liquidation mode, you can't withdraw it or add more collateral to your position. Should the price of the collateral drop sharply over a short time interval, your position will get hard-liquidated, with no option of de-liquidation. Please choose your leverage wisely, as you would with any collateralized debt position.

- If your collateral enters soft-liquidation mode, you can't withdraw it or add more collateral to your position.

- Should the price of the collateral change drop sharply over a short time interval, it can result in large losses that may reduce your loan's health.

- If you are in soft-liquidation mode and the price of the collateral goes up sharply, this can result in de-liquidation losses on the way up. If your loan's health is low, value of collateral going up could potentially reduce your underwater loan's health.

- If the health of your loan drops to zero or below, your position will get hard-liquidated with no option of de-liquidation. Please choose your leverage wisely, as you would with any collateralized debt position.

- The crvUSD stablecoin and its infrastructure are currently in beta testing. As a result, investing in crvUSD carries high risk and could lead to partial or complete loss of your investment due to its experimental nature. You are responsible for understanding the associated risks of buying, selling, and using crvUSD and its infrastructure.

- The value of crvUSD can fluctuate due to stablecoin market volatility or rapid changes in the liquidity of the stablecoin.

- crvUSD is exclusively issued by smart contracts, without an intermediary. However, the parameters that ensure the proper operation of the crvUSD infrastructure are subject to updates approved by Curve DAO. Users must stay informed about any parameter changes in the stablecoin infrastructure.